Why would I want to put my rental property in an LLC?

- Wili Baronet-Israel

- Mar 5

- 2 min read

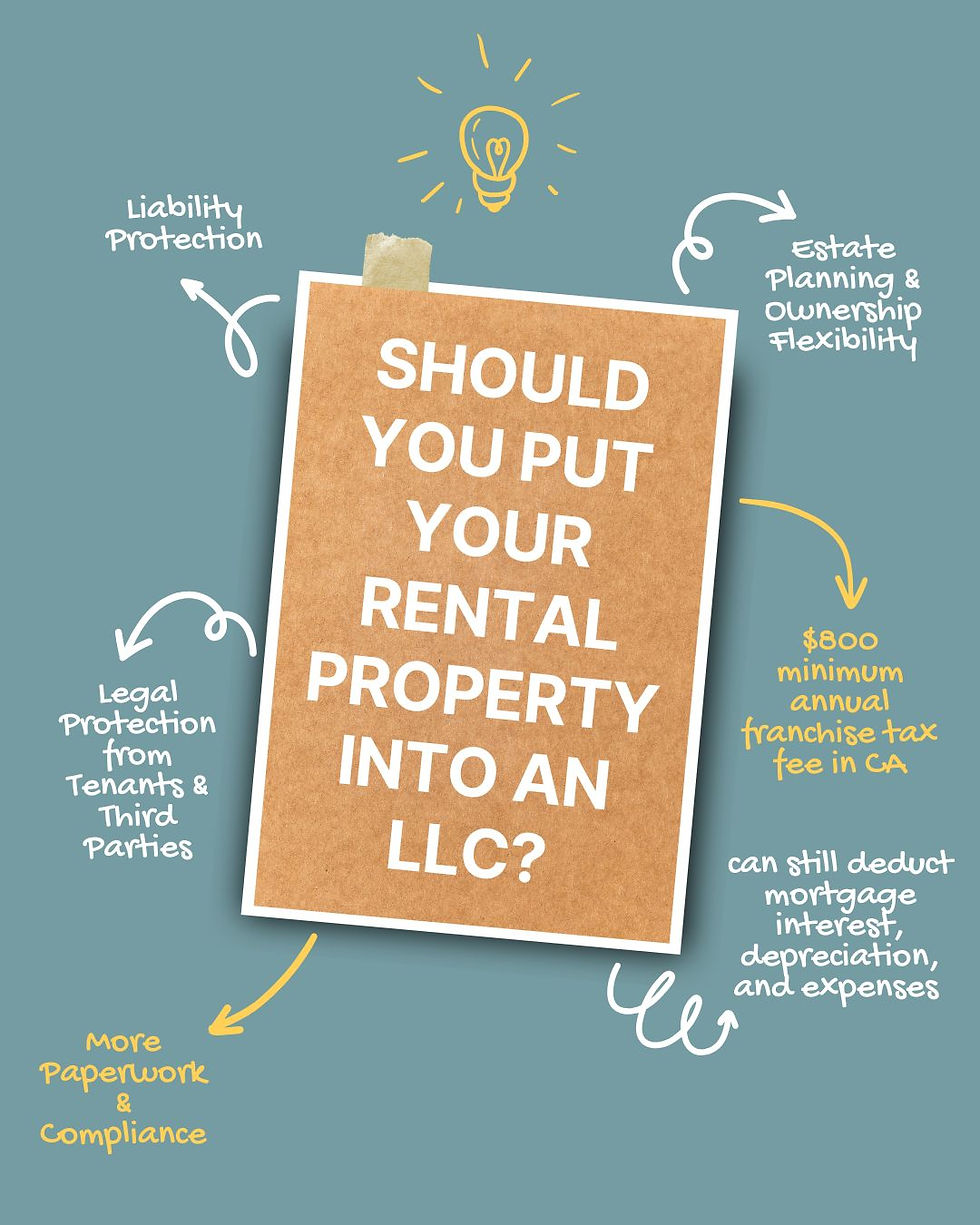

Putting your rental property in an LLC (Limited Liability Company) can provide several advantages, but it also comes with some drawbacks. Here’s a breakdown to help you decide:

Advantages of an LLC for a Rental Property

Liability Protection

An LLC separates your personal assets from the rental property. If a tenant or visitor sues you due to an injury or property damage, only the LLC’s assets (the rental property) are at risk, not your personal assets like your home, savings, or other investments.

Legal Protection from Tenants & Third Parties

If a tenant, contractor, or vendor sues the property owner, the LLC shields you personally from those claims.

Estate Planning & Ownership Flexibility

LLCs make it easier to transfer ownership or leave properties to heirs while avoiding probate.

Tax Benefits

LLCs are usually pass-through entities, meaning income and expenses pass through to your personal tax return, avoiding corporate taxes.

You can still deduct mortgage interest, depreciation, and expenses like an individual owner.

Credibility & Professionalism

If you own multiple rental properties, an LLC makes your business look more legitimate and professional when dealing with tenants, vendors, and lenders.

Easier Partnership Management

If you co-own a rental with someone else, an LLC provides a legal structure for clear profit-sharing, decision-making, and buyout terms.

Potential Drawbacks of an LLC

Financing Issues- Many lenders won’t finance a property under an LLC or may charge higher interest rates.

If you already have a mortgage under your personal name, transferring it to an LLC could trigger the "due-on-sale" clause, requiring full repayment.

Additional Costs

LLCs require formation fees, annual filing fees, and possibly business insurance.

In California, there's a minimum $800 annual franchise tax fee for an LLC.

More Paperwork & Compliance

LLCs require separate bookkeeping, bank accounts, and compliance with state laws.

Less Favorable Tax Treatment for Some

While LLCs offer pass-through taxation, they don’t provide self-employment tax savings like an S-corp might.

When It Makes Sense to Put a Rental Property in an LLC

✔ You own multiple properties and want liability protection for each.

✔ Your property is in a high-litigation area (e.g., California, New York, or vacation rentals).

✔ You partner with others on the property.

✔ You want to pass the property down easily without probate.

✔ You can buy the property outright or refinance under the LLC without triggering a due-on-sale clause.

When It Might Not Be Necessary

🚫 You only own one rental and have adequate landlord insurance.

🚫 Your mortgage has a due-on-sale clause and your lender won’t allow an LLC transfer.

🚫 You don’t want to pay California’s $800 annual franchise tax for an LLC.

Alternative Protection Without an LLC

High-Limit Landlord Insurance: A good landlord insurance policy with a high liability limit ($1M+) can protect you.

Umbrella Policy: Adds extra liability coverage (e.g., $2M-$5M) over your homeowner's or rental property policy.

Trusts: If estate planning is your main concern, a revocable or irrevocable trust might be a better option.